Forex Currency Trading Brokers: A Comprehensive Guide

Forex trading has gained immense popularity over the years, thanks in large part to the accessibility of online platforms. Selecting the right forex currency trading broker protradinguae.com broker can significantly impact your trading experience and success. In this guide, we aim to provide you with essential insights into the world of forex brokers, the factors to consider when choosing one, and tips that can enhance your trading strategies.

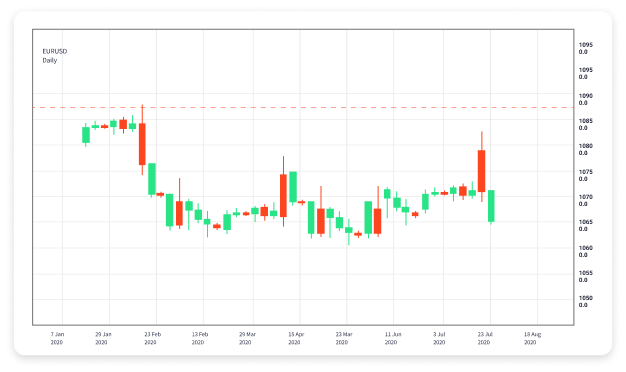

What is Forex Trading?

Foreign exchange trading, or forex trading, involves the exchange of one currency for another. It is one of the largest financial markets in the world, with trading volumes exceeding $6 trillion daily. Traders engage in forex to profit from fluctuations in currency values, seeking to buy low and sell high.

Importance of Forex Brokers

Forex brokers play a crucial role in facilitating trades between buyers and sellers. They serve as intermediaries, providing a platform for traders to access the forex market. Additionally, brokers offer various tools and resources that can aid in making informed trading decisions, including:

- Trading Platforms: Most brokers provide proprietary or third-party trading platforms that equip traders with advanced analysis tools and an interface to execute trades.

- Leverage: Brokers offer leverage, which allows traders to control larger positions than their actual capital would permit. While this can amplify profits, it also increases the risks.

- Research and Education: Many brokers offer educational resources, such as webinars, articles, and tutorials, to help traders enhance their skills and knowledge.

- Customer Support: A reliable support team is essential for addressing issues and providing assistance during trading hours.

Types of Forex Brokers

Forex brokers can be categorized based on their operations, and understanding these categories is vital when selecting the right broker for your trading needs:

- Dealing Desk (DD) Brokers: These brokers act as market makers, determining the buy and sell prices. They often offer fixed spreads and may have conflicts of interest since they profit from trader losses.

- No Dealing Desk (NDD) Brokers: NDD brokers connect traders to liquidity providers, offering variable spreads that reflect real market conditions. They can be divided into:

- STP (Straight Through Processing): Orders are executed directly in the interbank market, allowing for fast execution and better pricing.

- ECN (Electronic Communication Network): ECN brokers provide direct access to multiple liquidity providers, offering the tightest spreads and fastest execution times.

Choosing a Forex Broker

Selecting the right broker requires careful consideration of several factors:

1. Regulation

Ensure the broker is regulated by reputable financial authorities, such as the FCA (UK), ASIC (Australia), or NFA (USA). Regulation provides confidence that the broker adheres to strict financial standards.

2. Trading Costs

Different brokers have different fee structures, including spreads, commissions, and overnight fees. Compare these costs to understand how they will affect your profitability.

3. Trading Platforms

A user-friendly and powerful trading platform with advanced features can significantly improve your trading experience. Check if the broker offers widely used platforms, such as MetaTrader 4 or 5.

4. Customer Service

Efficient customer service is essential, especially for new traders. Evaluate the broker’s responsiveness, available communication channels, and support hours.

5. Available Currency Pairs

Check the variety of currency pairs the broker offers. A wider selection may provide more trading opportunities.

6. Leverage Options

Different brokers offer varying leverage options. Understand the risks associated with high leverage and choose a broker that aligns with your risk tolerance.

Forex Trading Strategies

With the right broker, you can implement various trading strategies to maximize your success:

1. Scalping

This short-term strategy involves making numerous trades throughout the day to capitalize on small price movements. Scalpers require a broker with fast execution speeds.

2. Day Trading

Day traders open and close positions within the same trading day, avoiding overnight exposure. A reliable broker with low spreads and fast execution is crucial for this strategy.

3. Swing Trading

Swing traders hold positions for several days or weeks, aiming to profit from price swings. This strategy requires a broker that supports technical analysis tools.

4. Position Trading

Position traders hold trades for extended periods, sometimes months, focusing on long-term trends. They often rely on fundamental analysis and require lower trading costs.

Final Thoughts

Choosing the right forex currency trading broker is essential for a successful trading experience. Consider factors like regulation, trading costs, and customer service when making your decision. With the right broker and a solid trading strategy, you can navigate the forex market with confidence and potentially achieve your financial goals.

Добавить комментарий